Read the full report here: Dead in the water

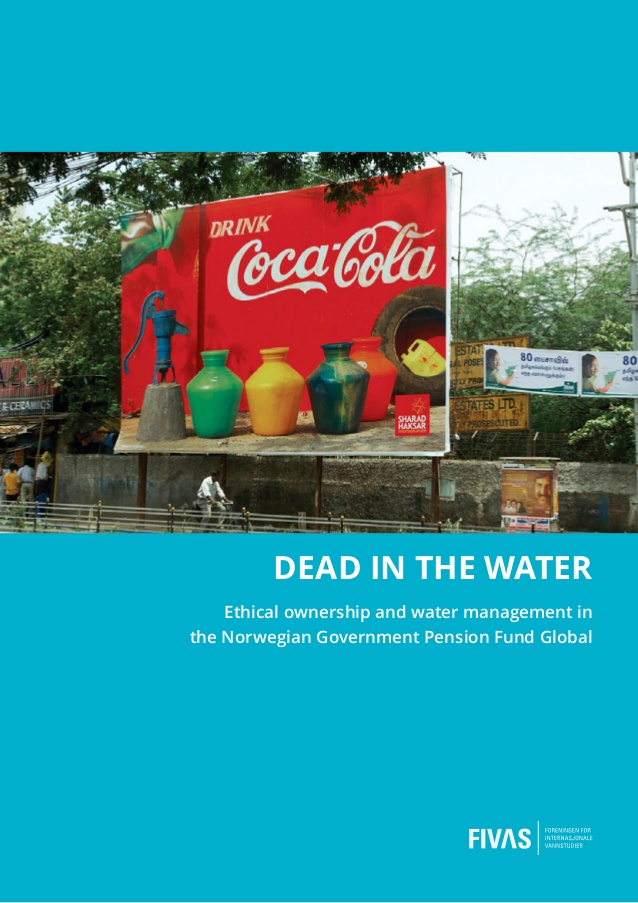

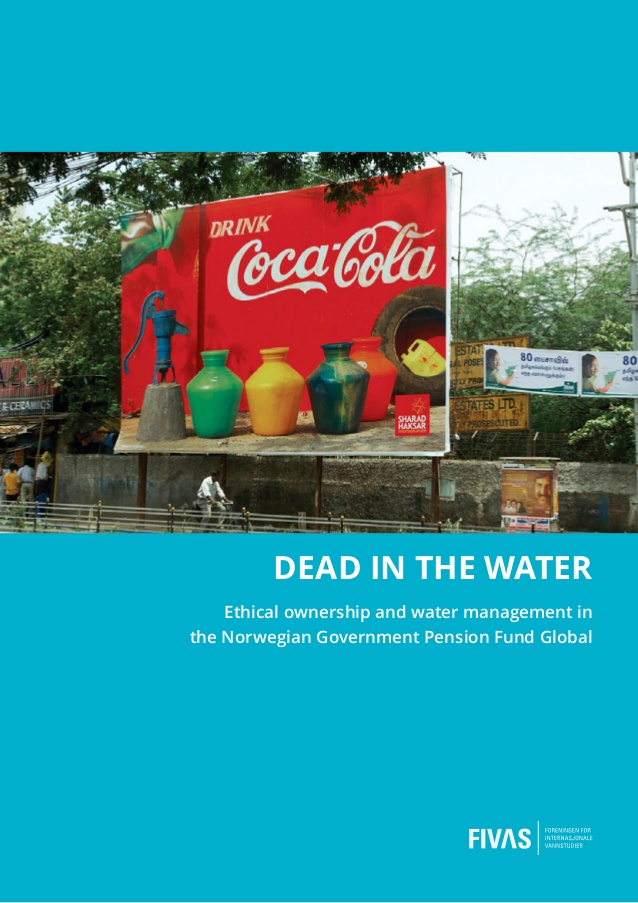

The world is facing a serious water crisis with increasing water scarcity and overuse globally. The demand for water resources is growing rapidly mainly due to industrial use, and beverage companies are one of the major industrial consumers.

Giant corporations such as Coca-Cola and Nestlé are currently expanding its production and sale of soft drinks and bottled water, especially in the Asian market due to a rapidly growing middle class. The commercial over-extraction and depletion of local water resources by these companies have led to considerable grievances and conflicts with affected communities fueled by the hardship caused by water shortage. The poor are the first to suffer under water scarcity.

A lack of safe and sufficient water affects both their ability to secure a livelihood and their health. This raises important questions regarding unethical corporate water management, severe environmental damage and the human right to water.

In Fivas’ new report these water issues are addressed and further discussed in the light of the heavy investments the Norwegian Government Pension Fund Global has put into The Coca-Cola Company and other beverage companies.

The Oil fund with heavy investments

The Norwegian Government Pension Fund Global is the largest sovereign wealth fund in the world and has vast sums invested in The Coca-Cola Company and Nestlé.

The Fund strives to be a responsible investor and regards sound management of water resources as a core priority. Sustainable water management is one of the fund management’s six strategic focus areas and the Expectation document on water management sets out their priority to all investee companies. The fund also has ethical guidelines covering human rights and serious environmental harm.

The Fund was an early mover in the field of ethical investments and has as such been a leading star. However, as far as we can see, there have been few, or none, external and critical analyses of the strategy on water management and the ethical guidelines in relation to the practice of water-intensive companies included in the investment portfolio. The main objective of the report is therefore to critically investigate and analyse the fund’s guidelines and practises on water management.

Serious cases of over-extraction from India and Pakistan

The report does this by firstly addressing and exploring the global water crisis, before mapping out the Fund’s governance structure and strategy on responsible investment. This is followed by a set of case studies representing companies where the Fund holds an ownership interest.

These are primarily concerned with three different Coca-Cola bottling operations and plants in India and have been selected due to their significant problems with commercial over-extraction of water. The cases display similar social and environmental problems, longstanding unethical practises and unresolved social conflicts – across different locations in India.

In addition, the report briefly touches upon Nestlé’s operations in Pakistan, which have encountered similar criticism to that of Coca-Cola in India. Both Coca-Cola and Nestlé’ it is part of the group of so-called “big 10” – the 10 most powerful food and beverage companies in the world, which together have a revenue of more than 1.1 billion USD a day. The industry as a whole represents 10 percent of the world’s economy.

Finally, the last section draws out and discusses the main findings from the different case studies on corporate water management practices against the Fund’s standards on water management and ethics.

Read the full report here: Dead in the water